Carlos Velásquez · Medium · 2 min read · Visual Capital

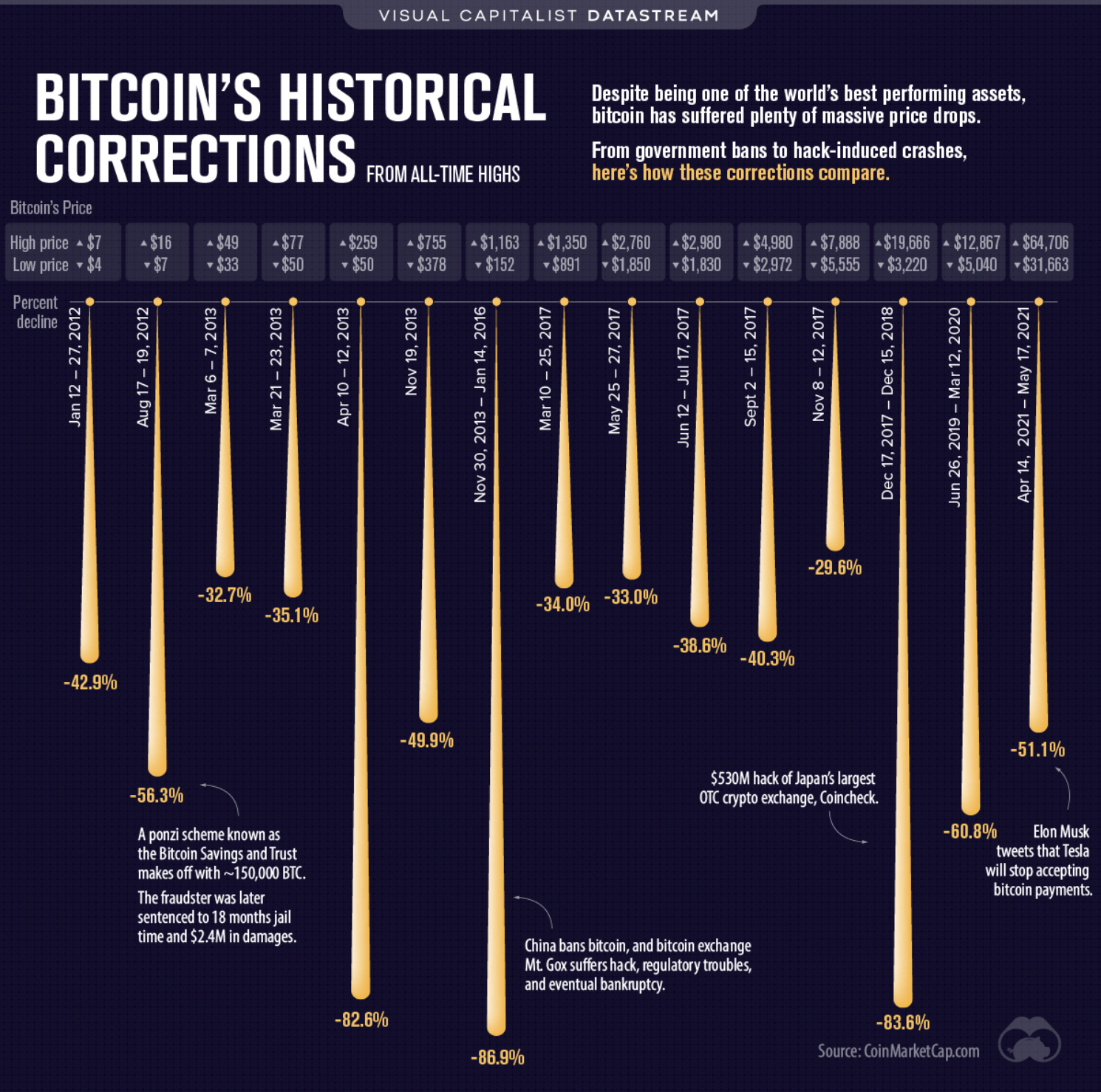

The above graphic is from Visual Capitalist, which depicts 15 of the most significant BTC price drawdowns dating back to January 2012.

Pronounced BTC price volatility is nothing new.

Three of the top seven drawdowns (45% or greater) have occurred in the last four years. As such, investors should expect this level of price volatility to continue, periodically, in the foreseeable future — and size their allocation to BTC accordingly.

The graph below, created by glassnode, illustrates the magnitude of the most recent losses compared to those during the 2018 and 2020 sell-offs. Given the prevalence of new investors in the cryptocurrency space, the current BTC price drop appears to have shaken out short-term BTC holders.

The latest BTC price action should nonetheless be put into perspective: long-term HODLers are in the black. And they are not selling.

Investors that reap the benefits of exponential returns are able to look beyond short-term volatility.

They position their portfolio to not become one of the weak hands, turned forced sellers, during drawdowns.

Author also wrote: Blockchain Stocks |50 Investment Lessons |Flywheel Effect | Bitcoin: Mental Framework | Crypto Moonshots | 4 Crypto Stocks | Bitcoin: Insurance | Brief History: Money | Spontaneous Order | Ackman’s $2.6B Moonshot | Fragility Inducing Events | Antifragile: Definition | 1% Bitcoin: 99% Cash | COVID-19: Market

twitter.com/Ctwitter.com/C1_Velasquez | carlosvelasquez-5316.medium.com/

Disclaimer: Topics covered herein are for informational purposes. Before acting on investment information, consult with a financial professional. This article is intended for people who understand the pro/con impacts of tail-risk, convexity, and asymmetric risk-reward in the context of an investment portfolio.