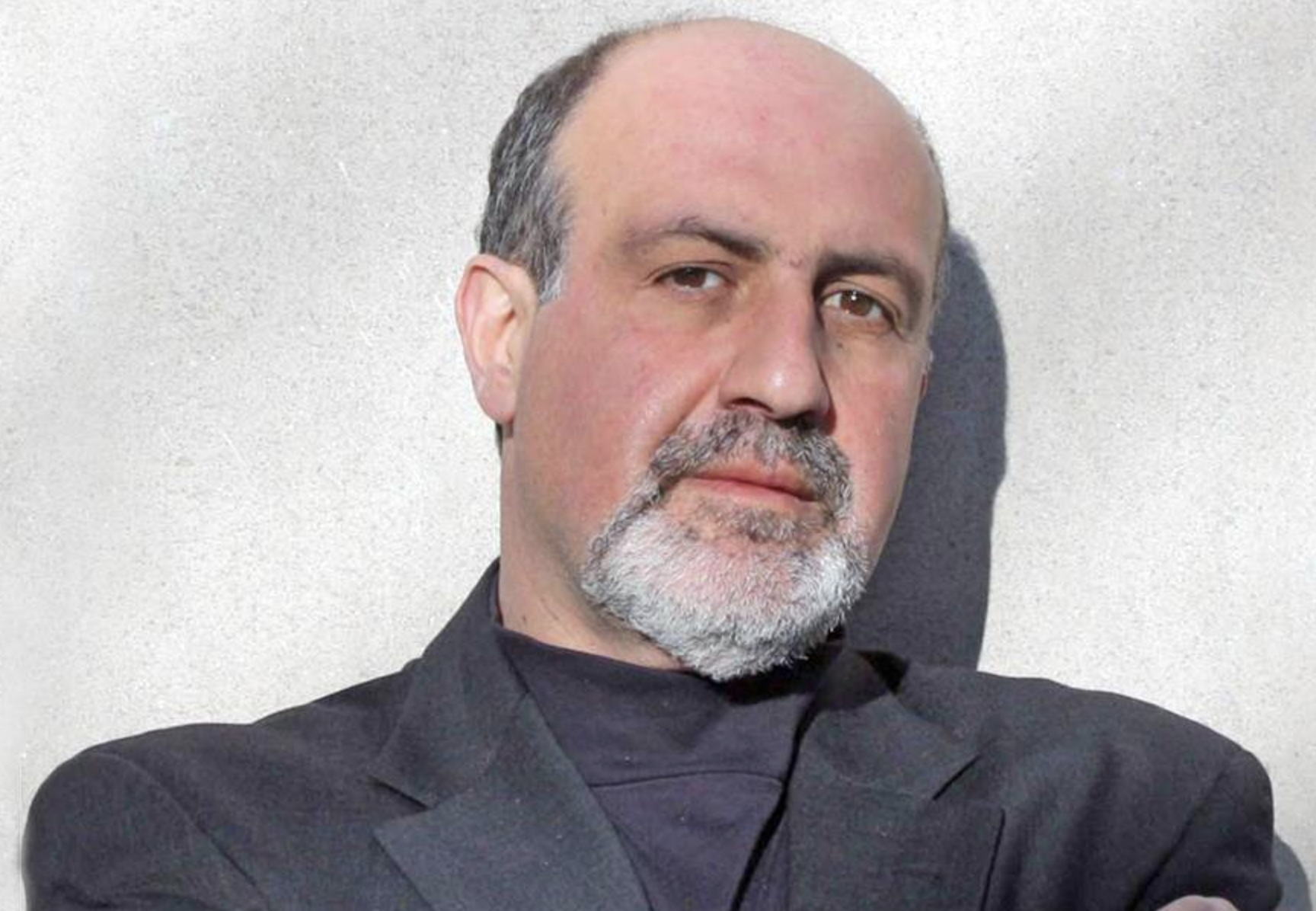

Carlos Velásquez · Medium · 11 min read · Photo from APB Speaking to the World Website

“We keep saying that fragility and antifragility mean potential gain or harm from exposure to something related to volatility. What is that something?

Simply, membership in the extended disorder family.

The Extended Disorder Family (or Cluster): (i) uncertainty, (ii) variability, (iii) imperfect, incomplete knowledge, (iv) chance, (v) chaos, (vi) volatility, (vii) disorder, (viii) entropy, (ix) time, (x) the unknown, (xi) randomness, (xii) turmoil, (xiii) stressor, (xiv) error, (xv) dispersion of outcomes, (xvi) unknowledge.” ~Nassim Taleb, Antifragile

The Extended Disorder Family crashed our party in 2020. Its members wreaked havoc to the tune of trillions of dollars with no indication of when they plan to leave.

Some financial entities were positioned to gain from their arrival. Society as a whole, however, has been harmed. Scars will remain.

Individually, we can protect ourselves against them using a “barbell”. I will explain.

In the meantime, let us meet the members of this unruly bunch.

In no particular (dis)order.

Uncle Error (The “xiv”)

Face Coverings (Lack Thereof): It took two months after NYC became the epicenter of the U.S. COVID-19 outbreak for some officials to agree that face coverings should be mandatory in public settings. Face coverings yield an asymmetric return: a small downside (slight discomfort) with a considerable upside (reduced probability of infection). A quicker response from officials could have prevented billions of dollars in losses and perhaps thousands of deaths. Yet face coverings are still not mandatory in all states.

Siblings: Donald Rumsfeld’s Godchildren

Uncertainty (The oldest “i”): Rumsfeld nicknamed him “Known-Knowns”. The cliché “the only thing I know, is that I know nothing”is more apt than ever. When will we be able to congregate indoors? When will normalcy return? No one knows.

Imperfect, Incomplete Knowledge (The “iii”): Rumsfeld nicknamed him “Known-Unknowns”. We know people with asymptomatic and pre-symptomatic COVID-19 cases can infect others; we do not know how many asymptomatic, pre-symptomatic, or symptomatic cases exist since only lab-confirmed infections are counted. We therefore cannot know the true infection rate of COVID-19.

The Unknown (The “x”): Rumsfeld nicknamed him “Unknown-Knowns”. The herd immunity threshold for COVID-19, if there is one, is unknown; we do know, however, that communities have been able to defend the most vulnerable members by developing herd immunity against other viruses.

Unknowledge (The “xvi”): Rumsfeld nicknamed him “Unknown-Unknowns”. We cannot know if more than one wave of COVID-19 infections will occur, how strong and widespread such infections could be, or in what mutated form (weaker or stronger) a new wave of infections could materialize in.

2nd Cousin Chance (The “iv”)

The Role Of Chance: The vaccine approval process usually lasts 10–15 years. What are the chances of developing an effective COVID-19 vaccine within 12-months of commencing research? What are the chances of discovering one that does not have negative side effects? In light of political pressures, will the FDA approve a vaccine with sufficient safety and efficacy data before deploying it? Chance drug discoveries involving trial-and-error that invited serendipity into the process are well documented. Medical discoveries are quasi “moonshots”. How much can sound science be rushed?

1st Cousin Variability (The “ii”)

Patients’ Genetic Variability: The genetic variations of infected patients appears to be linked to the severity of COVID-19 symptoms. Additionally, certain ethnic groups may be more susceptible to COVID-19 than others. Might the same vaccine, if and when developed, benefit genetically diverse groups equally? What might the challenges of developing herd immunity be in light of these variations?

Oldest Nephew Disorder (The “vii”)

Increase In Mental Health Disorders: Social isolation and general feelings of uncertainty have impacted people’s mental health. Souring relationships resulting from co-existing in close quarters while struggling to find work-life harmony are common. People with no history of mental illness are reporting feelings of depression or anxiety. Concerns for the well-being of elderly relatives add to stress levels. Society may not have experienced this level of collective mental health challenges since the war years of the 1940-50s.

Teenage Cousin Turmoil (The “xii”)

“I Can’t Breathe”: George Floyd, an African American, was arrested for allegedly using a counterfeit $20 bill. A police officer knelt on Floyd’s neck for nearly 9 minutes, causing his death. The officer’s actions agitated already tense relations between African American communities and local Police forces. Looting and violence ensued throughout the U.S. lasting several days, perhaps even fueled by the financial uncertainties and psychological impacts related to COVID-19.

Big-Brother Dispersion (The “xv”)

Dispersed Feedback Loops: Economic recovery scenarios currently have no clear base case. The “impact” element depicted in Figure 2 can include variables such as the U.S. Federal election results; earlier v. later economic reopening; the unemployment rate; fiscal and monetary response; trade imbalances; and stock market price levels. The dispersed array of potential outcomes illustrates how a slight variation in the “reaction” to any individual “impact” can lead to a widely varying “result”.

Not depicted in the diagram is the fact that a given result creates a continuous feedback loop: result>action > impact > reaction >result. “Reflexivity” is a different but related notion that describes how market participants’ collective perception (real and imagined) can also influence the various phases of the feedback loop. Reflexivity helps explain the formation of asset bubbles that form and ultimately pop in financial markets. The feedback loop makes economic forecasting as challenging as making accurate Bitcoin price predictions. (The price of Bitcoin is also is influenced by a feedback loop).

Grand Nephew Stressor (The “xiii”)

Worldwide Debt Stress: Nassim Taleb joined others in warning the world is living in a debt crisis, before COVID-19. The pandemic has further stressed the budgets of most countries. Some have added billions of dollars of debt to their balance sheets in order to maintain economic stability. McKinsey reported that Governments’ stimulus-response amounted to $10 trillion during the first two months of the pandemic, “three times more than the response to 2008-09; they include “guarantees, loans, value transfers…and equity investments.”

Brother-In-Law Volatility (The “vi”)

Stock Market Volatility: The VIX Index is used as a proxy to measure stock market volatility. The VIX Index fluctuated mostly within the 10–25 range during the four years prior to COVID-19, yet experienced a fivefold increase by March 16th relative to its 2019 lows. It has remained at or above levels rarely seen since the Global Financial Crisis of 2008. In 2020, individual stock price movements have been markedly more volatile than the volatility depicted by the VIX. Small-cap stock prices have been more volatile still.

3rd Cousin Twice Removed Chaos (The “v”)

March-April Chaos: what initially appeared to be yet another overseas medical issue quickly turned into a pandemic. Within weeks, public events were canceled, office work took place remotely and shelter-in-place effectively locked-down major cities. Some social circles had to further contend with illness and, in worse case scenarios, death. The financial impact of job and investment losses, closed business ventures and canceled expansions were felt immediately. The disappointment resulting from called-off social gatherings and changes in living arrangements have added to the chaos.

Paternal Grandfather Entropy (The “viii”)

An Entropic Recovery: Entropy is the measure of disorder in a system. Just like the entropy of water increases when the temperature increases, the entropy of the stock market increases when economic uncertainty increases. As leading indicators of the “real” economy, sector-specific stock market indices (sector-specific ETFs can be used as proxies) provide early telltale signs of the financial stress COVID-19 impacts may have on sector-specific employment, wage levels and productivity. The stock prices of non-Tech sector companies have experienced a disorderly “K-shape” recovery, not the neater V-shape recovery widely celebrated by buy-and-hold investors who invested in the S&P 500 Index (black line in the chart).

Maternal Grandfather Randomness (The “xi”)

Skewed Randomness: Figure 8 depicts a gray ball falling randomly into columns of balls distributed in a Bell Curve-shaped (or Gaussian) distribution. In the current environment, these balls can represent the fragility inducing events that have unfolded in 2020. Their impact, however, has not been normally distributed.

The outcomes have been skewed closer to the darken left-tail in Figure 35 representing “unseen rare events”. Complex systems produce a lot of information. Determining relational cause-and-effect is difficult. Predictive models using this information are, as such, prone to vastly underestimating the likelihood of tail-risk events.

Father Time (The “ix”)

Time Invites Disorder: Time gives the other members of the Extended Disorder Family unlimited opportunity to create mischief. If a 20-year-old agrees with the adage that “history doesn’t repeat itself, but it sure does rhyme”, she can refer to the past 60 years of market drawdowns for an indication of what Father Time has in store. An 80-year old who has invested in the broader U.S. stock market since 1961 (the first 500 Index fund was offered by Vanguard on December 31, 1975) would have experienced the following percentage drawdowns, peak-to-trough.

Prolonged bear markets like the Dot.com Bubble that began deflating in 2000 could be less volatile than precipitously falling markets like that of March 2020 (see black arrows). Yet from peak-to-trough, extended downturns can add up to even bigger losses: 49% in 2000–2003 compared to 34% in 2020. During drawdowns, investors that experience long-term job loss often become forced sellers of assets at depressed prices. Portfolios with concentrated stock positions could experience even bigger drawdowns than the broader market.

Barbell Strategy: Crisis Alpha

“The characteristic feature of the loser is to bemoan, in general terms, mankind’s flaws, biases, contradictions, and irrationality — without exploiting them for fun and profit.” ~ Nassim Taleb, The Bed of Procrustes

Crisis alpha refers to investment strategies that reap superior risk-adjusted returns during crises. Trend-following strategies are thought to provide crisis alpha, although this notion is debatable because crises happen suddenly, not in trends.

Since investment “alpha” refers to excess returns above and beyond that of an index (often the S&P 500) cash and cash-equivalents returning close to 0% necessarily provide relative alpha when the market suffers 25%-60% losses.

“By grasping the mechanisms of antifragility we can build a systematic and broad guide to nonpredictive decision making under uncertainty in business, politics, medicine, and life in general — anywhere the unknown preponderates, any situation in which there is randomness…” ~ Nassim Taleb, Antifragile

A barbell investment strategy consists of a 10%-15% allocation in speculative investments, the rest in cash and/or cash-equivalents.

Step 1 of a barbell investment portfolio construction entails establishing a 85%-90% ultra-conservative position; this requirement is largely accomplished with the cash-heavy “crisis alpha” play.

Step 2 entails allocating the remainder of the portfolio strictly into speculative “moonshots”. This second step converts exponential return exposure, via moonshot bets, into one’s portfolio edge.

The 10%-15% moonshot allocation, consisting of hundreds of bets, can underperform — or significantly overperform — relative to the S&P 500 Index at any point in an economic cycle. Importantly, the downside risk of the moonshot portion of the portfolio is bound, but its upside exposure to convex returns is not.

Constantly looking for moonshot investments during normal market conditions enables one to cope with the psychological challenges of “not being in the market” because one, in fact, is in it at all times — granted at a reduced scale of 10%–15%. Betting exclusively on positions with convex return potential justifies this reduced scale.

Crucially, a barbell investment strategy guarantees one will have “dry powder” in the midst of a crisis, when fewer investors do, and when prices are depressed.

“Antifragility is not just the antidote to the Black Swan; understanding it makes us less intellectually fearful in accepting the role of these events as necessary for history, technology, knowledge, everything.” ~ Nassim Taleb, Antifragile

Psychologically, one can think of the small moonshot investments made during normal market conditions as the necessary “decision-reps” required to improve one’s ability to size-up and seize opportunities, without fear or hesitation, during abnormally over-sold markets. This is akin to the thousands of reps world-caliber athletes take when training between Olympics. Crises, like the Olympics, are periodic. But crisis alpha and gold metals are rare.

Savvy investors should be able to capitalize on these periodic opportunities using a playbook that fits his or her personality.

A fundamental understanding of stock market history and its accompanying volatility will, no doubt, help.

“I have made the claim that most of history comes from Black Swan events, while we worry about fine-tuning our understanding of the ordinary, and hence develop models, theories, or representations that cannot possibly track them or measure the possibility of these shocks.” ~ Nassim Taleb, Antifragile

Having sharpened one’s “edge” between crises will improve one’s odds of finding alpha during crises. As in any competitive endeavor, the most mentally prepared usually rises to the occasion.

Unfit and ill-prepared investors will forever bemoan the irrational and unpredictable fragilities induced by Father Time.

While fit and well-prepared Antifragile investors seeking crisis alpha will be well-positioned to exploit his kin.

Author also wrote: N. Taleb’s Minority Rule | Your Inner Voice | Bitcoin’s Volatility | Blockchain Stocks | 50 Investment Lessons | Flywheel Effect | Bitcoin: Mental Framework | Crypto Moonshots | 4 Crypto Stocks | Bitcoin: Insurance | Brief History: Money | Spontaneous Order | Ackman’s $2.6B Moonshot | Fragility Inducing Events | 1% Bitcoin: 99% Cash | COVID-19: Market

twitter.com/C1_Velasquez | carlosvelasquez-5316.medium.com/

Disclaimer: Topics covered herein are for informational purposes. Before acting on investment information consult with a financial professional. This article is intended for people who understand the pro/con impacts of “tail-risk,” “convexity” and asymmetric risk-reward in the context of an investment portfolio.