Carlos Velásquez · Medium · 7 min read · Image Source: Tweet

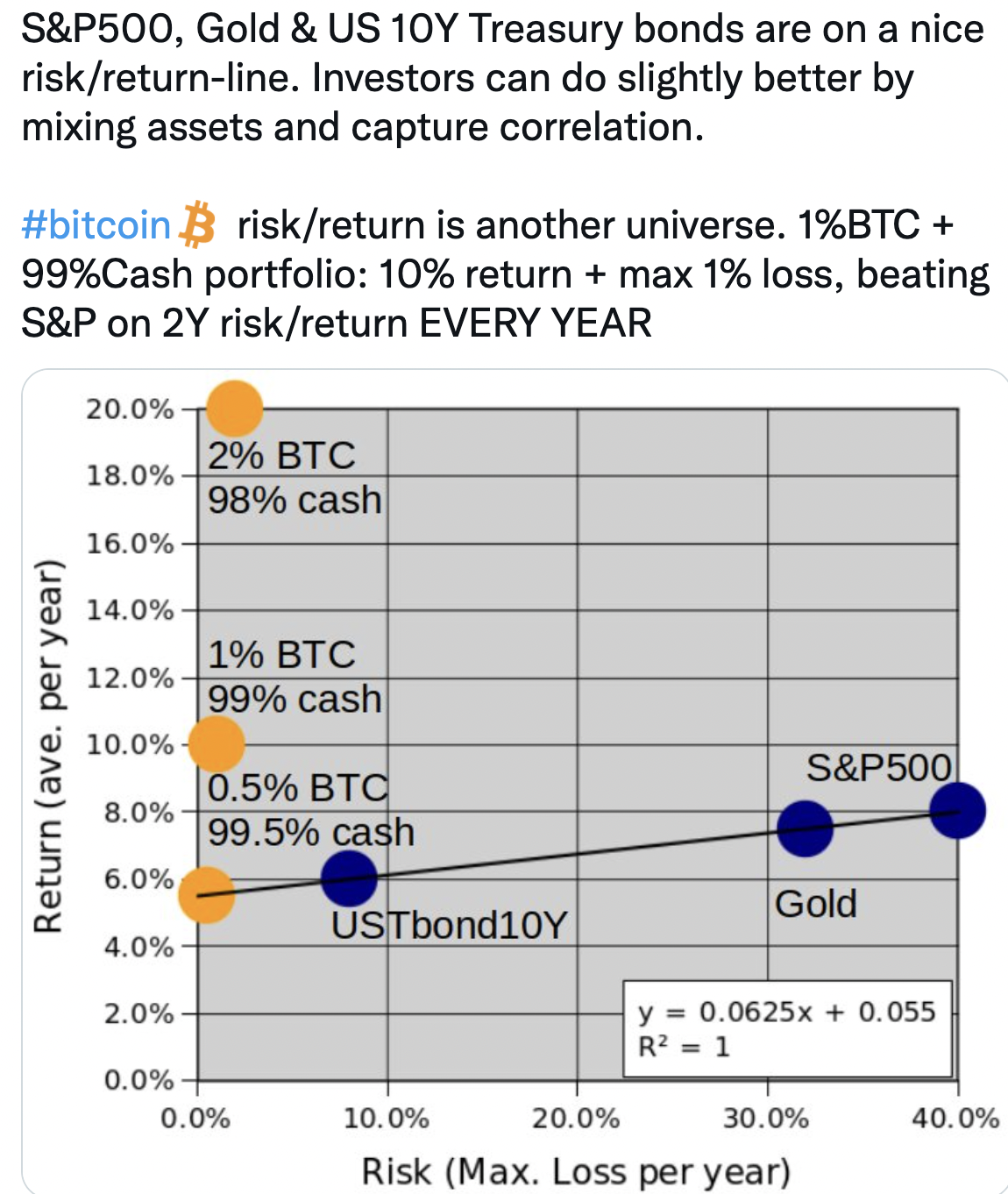

In early 2019 the Bitcoin community circulated the tweet below noting that a 1% Bitcoin / 99% cash position would have outperformed the S&P 500 “every year” on a two-year risk-to-return basis.

The date and purchase price were unstated but the point was clear: a 1% Bitcoin / 99% cash position would have beaten the average historical returns of the S&P 500 while reducing the associated risk.

On September 1, 2011, a hypothetical $100,000 portfolio with a 1% Bitcoin position (at $8.21 per coin) and a 99% cash position would have been worth $1,556,272.84 exactly nine years later. During the same period, a $100,000 portfolio allocated 100% into an S&P 500 Index fund would have been worth $292,808.98 nine years later.

Is survivorship bias at play when comparing Bitcoin to the S&P 500?

Or can 20/20 hindsight provide a valuable lesson in “positive convexity”?

Rolling A Six Sided-Die: Find Your Edge

“Take a conventional die (six sides) and consider a payoff equal to the number it lands on, that is, you get paid a number equivalent to what the die shows —1 if it lands on 1, 2 if it lands on 2, up to 6 if it lands on 6. The square of the expected (average) payoff is then (1+2+3+4+5+6 divided by 6), equals 3.5, here 12.25. So the function of the average equals 12.25…” – Antifragile, Nassim Taleb

The Function Of The Average

“…But the average of the function is as follows. Take the square of every payoff, 1^2+2^2+3^2+4^2+5^2+6^2 divided by 6… since squaring is a convex function, the average of the square payoff is higher than the square of the average payoff…” – Antifragile, Nassim Taleb

The Average Of The Function

“…The difference here between (average of the function) 15.17 and (the function of the average) 12.25 is what I call the hidden benefit of antifragility—here, a 24 percent ‘edge.’” – Antifragile, Nassim Taleb

The numerical outcomes of six-sided die rolls are conceptually useful but of secondary importance in the examples above. Understanding the power of convexity via the nuanced changes in the equation, however, is key.

Bitcoin v. S&P 500’s Best Decade: No Contest

“… if you have favorable asymmetries, or positive convexity, options being a special case, then in the long run you will do reasonably well, outperforming the average in the presence of uncertainty. The more uncertainty, the more role for optionality to kick in, and the more you will outperform. This property is very central to life.” – Antifragile, Nassim Taleb

This past decade Bitcoin epitomized favorable asymmetry.

The tables below include one, two, and three-year average returns associated with Bitcoin and the S&P 500 since 2011. Precise equations are unnecessary to determine that an investment in Bitcoin provided significantly more “positive convexity” than an equal investment in the S&P 500 Index.

Asserting “survivorship bias” to Bitcoin when comparing it to the S&P 500 Index in this context would be premature. Bitcoin, DOB January 12, 2009, is still a “pre-teen”. It may or may not reach “adulthood”, but if it does consider the following:

- 0.5%: Percentage of the world using the Internet in 1995

- 60%: Percentage of the world using the Internet in 2020

- 0.5%: Percentage of the world using Bitcoin in 2020

What might the price of Bitcoin be if and when 60% of the world’s population is using it?

Moreover, this past decade Bitcoin is but one of a few favorable asymmetric bets one could have made in the cryptocurrency space.

Yahoo Finance charts that from August 8, 2015 to the end of 2015 Ethereum (ETH) was at times worth less than $1. A $1000 investment in ETH at $1 a coin would have increased to $440,000 on September 1, 2020. A $1,000 bet on Ripple (XRP) at $0.0055 a coin in the mid-September to mid-November 2014 timeframe would have been worth $50,273 on September 1, 2020 ($0.2765 per coin). Similar positive convex returns would have been netted if one had invested $1000 in Stellar (XLM), Neo (NEO) and Tron (TRX) during the first few days after these Altcoins’ respective Initial Coin Offerings.

The point though is not to be bullish on cryptocurrencies. Not all have done well.

The point is to be bullish on asymmetric bets resulting in positive convexity as exemplified in the diagrams below. For the self-initiated and patient, the stock market is full of these bets.

Not Your Parents’ Stock Market: Innovation Beta v2.0

Reflect back 10, 20 or 30 years.

Perhaps the emergence of autonomous vehicle capabilities, blockchain technologies, hand-held devices, powerful search engines, personal computers or the internet come to mind.

Now gaze into the future. What might you see?

In the next decade entire industries will undergo more technological progress than they have in the past 100 years. Business models will be disrupted, even done away with. New businesses and services will be made possible by advances in innovations such as augmented and virtual reality, sensors, robotics, blockchain and artificial intelligence.

And a lot of money will be made.

“…it used to be that you could be an expert in any one technology, and you’d be amazing. But today, it’s really the combination of three, four, five of these converging and creating new business models. It’s not just augmented reality. It’s augmented reality plus 5G plus AI, reinventing retail; 3D printing plus machine learning plus robotics plus material sciences, reinventing transportation…it’s these combinations…

Some of the companies that could benefit from the innovations Peter Diamandis refers to are small-cap companies currently listed on stock exchanges. Think Apple and Amazon share price appreciation circa 2000 to present.

…we’re going to create more wealth in the next ten years than we have in the entire past century, and every industry is going to change.” — Peter Diamandis, coauthor of The Future is Faster Than You Think. ( “TIP 272 X-Price Founder Peter Diamandis & Steven Kotler on the speed of technology”. On We Study Billionaires Podcast.)

The breadth of technological advancement will be too widespread to only be captured within the Venture Capital space.

Convex Transformation: Street Hustlers & 20-Sided Die

“…we may never get to know x, but we can play with the exposure to x, barbell things to defang them; we can control a function of x, f(x), even if x remains vastly beyond our understanding. We can keep changing f(x) until we are comfortable with it by a mechanism called convex transformation, the fancier name for the barbell.” – Antifragile, Nassim Taleb

Time travel back to the evening of September 1, 2011 for a minute.

Your boys are hollering at you to go out. It is only Thursday, but it has already been a long week. You decide to stay home. That night, you finish reading the last few pages of The Black Swan: The Impact of the Highly Improbable. Not completely sold on the barbell investment strategy you decide to test the idea: the $200 you would have spent on Uber, dinner, night-club and drinks trying to get “lucky” you decide to invest in this thing called “Bitcoin” you have been hearing about. You figure you just might still get lucky, but in a different way!

That night’s $200 bet would have bought 24.36054 Bitcoin and would have been worth a total of $291,454.54 nine years later. The $100,000 investment you could have made in the S&P 500 Index on September 1, 2011 would have appreciated to $292,808.98 nine years later.

The good news is that you do not need Bitcoin-like returns to get lucky.

A typical barbell investment strategy consists of 10-15% moonshot bets, of which you make many. The rest of the portfolio is kept in cash equivalents, limiting your risk.

Extending your investment horizon to 12-24+ years organically increases the chances to reap the benefits of moonshot bets. Again, exponential returns are necessarily a function of time.

Heed Peter Diamandis’ research. You would be remiss not to consider the rate at which business innovation is occurring. Profits may be captured by investors who bet on technological transformation early on. Asymmetric risk-reward exposure to this inevitable transformation can be had through moonshot investments.

Wall Street hustlers of the future may well be playing a brand-new Craps game rolling a 20-sided die.

Don’t get left behind rolling a six-sided die striving for Function Of The Average returns.

Author also wrote: N. Taleb’s Minority Rule | Your Inner Voice | Bitcoin’s Volatility | Blockchain Stocks | 50 Investment Lessons | Flywheel Effect | Bitcoin: Mental Framework | Crypto Moonshots | 4 Crypto Stocks | Bitcoin: Insurance | Brief History: Money | Spontaneous Order | Ackman’s $2.6B Moonshot | Fragility Inducing Events | Antifragile: Definition | COVID-19: Market

twitter.com/C1_Velasquez | carlosvelasquez-5316.medium.com/

Disclaimer: Topics covered herein are for informational purposes. Before acting on investment information consult with a financial professional. This article is intended for people who understand the pro/con impacts of “tail-risk,” “convexity” and asymmetric risk-reward in the context of an investment portfolio.